Main content

Charitable Giving

Sutter Roseville Medical Center Foundation

Gifts of Life Insurance

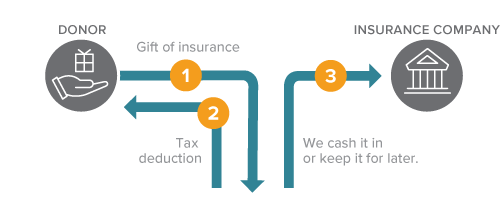

How It Works

- You transfer ownership of a paid-up life insurance policy to Sutter Roseville Medical Center.

- SRMC Foundation elects to cash in the policy now or hold it.

Benefits

- Make a gift using an asset that you and your family no longer need.

- Receive an income tax deduction equal to the cash surrender value of the policy.

- You may be able to use the cash value of your policy to fund a gift that delivers income, such as a deferred gift annuity.